Trusted healthcare analytics and proven expertise

Enhance health and benefits programs and inform decision-making with healthcare data analytics and member engagement tools.

Morgan Health invests in Merative

Morgan Health announced its investment as part of its mission to help employers improve the quality, affordability, and equity of healthcare by improving access to data. Read announcement

WHAT IS TRUVEN?

Make confident health and benefits program decisions with healthcare data analytics

40+

Trusted by leading health plans, employers, benefits advisors, government agencies, providers, pharmaceuticals, biotech, and medical device companies for over 40 years.

Truven solutions

Trusted healthcare analytics and methodologies

Take the pain out of analyzing data with data management and analytic enrichment. Drill down into the top KPIs with dashboards and visualizations or explore off-the-shelf, predictive analytics.

Flexible decision support and price transparency tools

Be a champion for members and a partner to business leaders. Improve the employee experience, streamline the benefits enrollment process, and exceed price transparency regulations.

Robust healthcare benchmarking data

Benchmark and compare healthcare program performance with representative, closed claims datasets spanning over 293 million patient lives with MarketScan®.

TRUVEN HEALTH INSIGHTS

Spend less time analyzing healthcare data and more time driving outcomes

-

Leading data quality

-

Time-tested analytics

-

Health analytics expertise

“We look to Truven to help create measurement strategies to evaluate some of the benefits designs and program changes we’ve made over the years.”

Ethan Rush, Director of US Medical Benefits, Eaton Corporation

“Truven really did a lot of listening. They understood the questions we were asking, and their experience allowed us to move quickly. From my perspective, they had it and they ran with it.”

Chief Medical Officer for Population Health Services, Regional Health System

“Nobody builds a data warehouse like Truven.”

VP, Employee Benefits Analytics, Large U.S. Healthcare System

“Truven is helping us look at data differently than we did before. The software, plus predictive analytic and continuous measurement capabilities, allows us to drive smarter decisions through better outcomes – and save our large & small groups money.”

Drew Hobby, Chief Revenue Officer, Blue Cross of Idaho

“A few years ago, Truven Health Insights was considered a nice-to-have. Now it’s a must-have.”

Business Process Owner, State Government Office

“I love the new version of Health Insights! It makes things easier, provides me more flexibility, while keeping all the power that I have grown to rely on.”

Health Data Analyst Lead, Large Public University

“We look to Truven to help create measurement strategies to evaluate some of the benefits designs and program changes we’ve made over the years.”

Ethan Rush, Director of US Medical Benefits, Eaton Corporation

“Truven really did a lot of listening. They understood the questions we were asking, and their experience allowed us to move quickly. From my perspective, they had it and they ran with it.”

Chief Medical Officer for Population Health Services, Regional Health System

“Nobody builds a data warehouse like Truven.”

VP, Employee Benefits Analytics, Large U.S. Healthcare System

“Truven is helping us look at data differently than we did before. The software, plus predictive analytic and continuous measurement capabilities, allows us to drive smarter decisions through better outcomes – and save our large & small groups money.”

Drew Hobby, Chief Revenue Officer, Blue Cross of Idaho

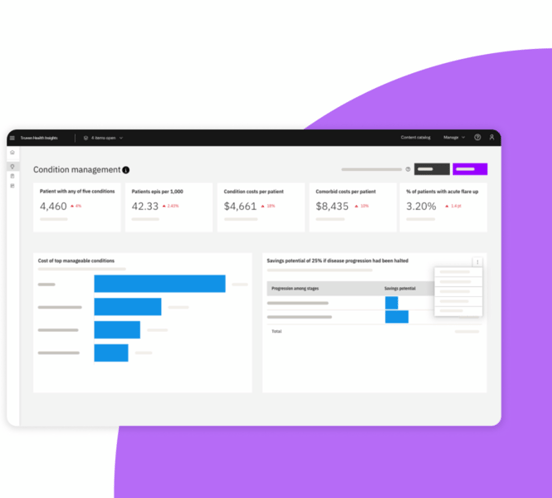

FOR QUICK INSIGHTS

Self-service dashboards

-

Aggregate data across all vendor types and layer on business intelligence for simpler, faster analysis

-

View aggregate KPIs and trends affecting your population’s health and costs

-

Dive deeper into patient populations with guided drill paths and filters

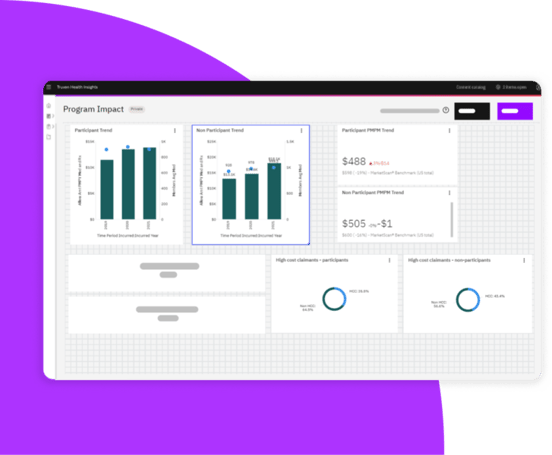

FOR DO-IT YOURSELFERS

Explore data your way

-

Personalize your experience in the Visualization Studio with data visualizations and metrics that reflect your unique business needs

-

Jumpstart any dashboard into a custom view with pre-made modules to make your insights even more relevant

-

Collaborate on dashboards and reports created by your community of users from our new Content Catalog

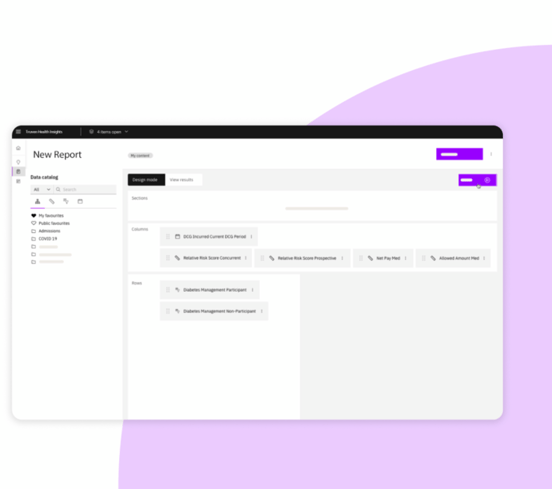

FOR POWER USERS

Advanced reporting

-

Investigate your top program questions with Ad Hoc Report Writer

-

Tailor-made for power users who want to perform detailed analyses, such as program comparisons that can uncover potential savings

-

Evaluate specific cohorts for population health outcomes and program performance

FOR EASY & SECURE COLLABORATION

Secure foundation and functionality

-

Built on Microsoft Azure to support scalability, reliability, performance and important security and compliance framework like HIPAA

-

Optimized to dramatically reduce the amount of time it takes to glean value from data

-

Designed to provide easy-to-find, comprehensive insights into care management programs and point solutions

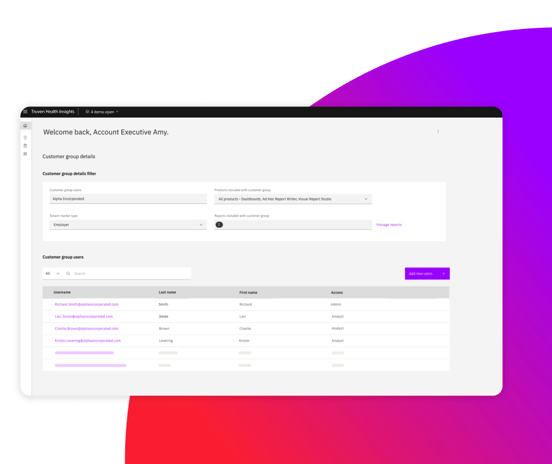

FOR HEALTH PLANS & BENEFITS ADVISORS

Employer group reporting

-

Demonstrate value to your employer groups with visually compelling and analytically robust employer insights at scale

-

Confidently engage and consult your clients with actionable insights you can trust

-

Free up and redeploy your talent to higher-value client-oriented tasks

SERVICES

Deep expertise with decades of experience

Evaluate programs

Evaluate employee and patient engagement, behavior change, and outcomes from programs. Giving you a better idea of if your point solution vendors are delivering expected ROI or value.

Identify gaps

Better understand opportunities to improve costs or address patient outcomes across key areas like behavioral health, prescription drugs, health equity, value-based care, and more.

Grow your business

Leverage our industry expertise along with robust data sources and analytics to provide the substantiation and differentiation your organization needs to stand out.

RESOURCES

Learn more about Truven Health Insights

How employers are reducing costs and improving health

See the top seven ways employers are using Truven Health Insights to improve employee health and financial outcomes.

Health analytics to meet pivotal moment in healthcare

The future of health analytics is here. See the details behind the new enhancements we’ve made to the Health Insights platform.

How payers can prepare for 2025

A conversation between our CEO and IDC on the challenges and opportunities facing employers and health plans as we prepare for 2025.